OnemdbOng: May 2022

Prologue

Authorities worldwide have been tracking funds that flowed from 1MDB into the ensnarled high-end art world and real estate bought in foreign lands , the super yacht Equanimity, the private Bombardier Global 5000 plane and the Hollywood movie production “The Wolf of Wall Street” chronicling an era of high deals in financial misdeeds.

1 EQUANIMITY

Equanimity is the name of a super yacht – that disproportionally sank a nation into economic instabilities with uncertainty.

Malaysia has sold the Equanimity by early 2019 to the Genting Group which renamed the superyacht Tranquility, with her current position at west Mediterranean (coordinates 41.36875 N / 2.18684 E); the vessel arrived at the port of Barcelona, Spain on Apr 28, 07:31 UTC under the flag of Cayman Islands.

In April 2019, it was reported that the Genting Malaysia Bhd or its special purpose vehicle (SPV) company was buying the Equanimity for US$126 million.

According to the former Attorney General Tommy Thomas, (read his book: My Story:Justice in the Wilderness), the Sheriff’s commission for the private treaty sale of the superyacht involved in the 1MDB scandal was $126 million, ( The Guardian ). It had previously been up for sale about half its original purchase price, according to Bloomberg.

The yacht specialist Burgess was the broker for the sale. Burgess CEO Jonathan Beckett said in a company-released Q and A sheet that the yacht has been on the market since the end of October 2018.

Equanimity gained notoriety when she was impounded at Benoa Bay in Bali, on Feb 28, 2018 duringthe investigation into the 1Malaysia Development Berhad (1MDB) scandal, in which US$4.5 billion from the 1MDB fund was misappropriated. It previously belonged to the fugitive Malaysian banker Low Taek Jho, who is believed by US authorities to be the mastermind behind the scandal.

According to Bloomberg, the Malaysian government had been spending up to US$500,000 per month to maintain the yacht.

i) This event come at a time when, according to the UNDP 1997 Human Development Report, and the 2004 United Nations Human Development Report, Malaysia has the highest income disparity between the rich and poor in Southeast Asia, greater than that of Philippines, Thailand, Singapore, Vietnam and Indonesia.

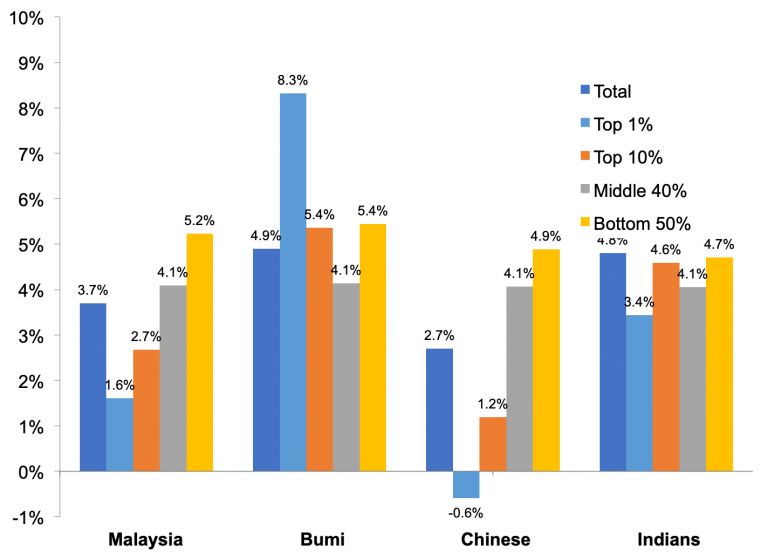

ii) Whence the share of the wealth is acutely benefitting the high-income group of capital-endowed class – especially the top 1% of bumiputera ethnocapital class is way above the national income, and of, other communities incomes, too:

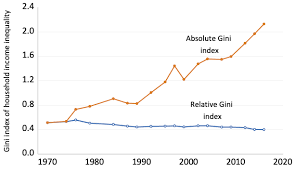

iii) Where the difference between income earned, and wealth disparity, had been accentuated through the years :

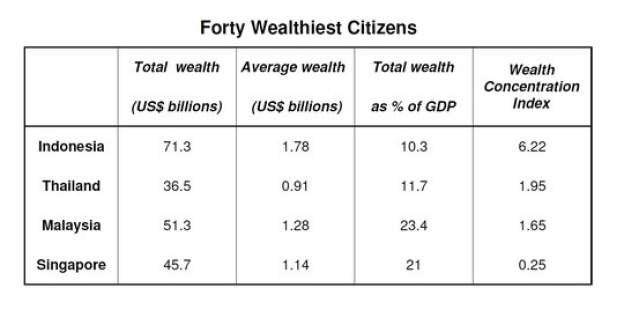

iv) What succeeding oligarchy regimes had maintained is a clientel ethnocapitalism domination over the working class rakyat2 with 1% of the bumiputera population (see Khalid lse.blog) or about 40,000 ethnocapital political families running and looting – and ruining – the national economy:

Therefore, present urban poverty reality has little to do with a lack of jobs or housing shelters , but rather it is firmly rooted in the mode of capitalism itself, and the exploitation and alienation of labour, upon which the expropriation system is hinged.

2 BOMBARDIER GLOBAL 5000

KEY POINTS

- A U.S. court has allowed the sale of a private jet allegedly bought by fugitive financier Low Taek Jho with money taken from Malaysia’s scandal-linked state fund 1MDB, court filings showed.

- The Bombardier Global 5000 jet is among $1.7 billion in assets allegedly purchased by Low, also known as Jho Low, and his associates with funds stolen from 1Malaysia Development Berhad (1MDB).

The Bombardier Global 5000 jet is among $1.7 billion in assets allegedly purchased by Low, also known as Jho Low, and his associates with funds stolen from 1Malaysia Development Berhad (1MDB), the U.S. Department of Justice (DoJ) has said.

The jet is the second asset linked to 1MDB to go on sale.

A judge in a California court had agreed to a proposal between the DoJ and the company that owns the jet, Global One Aviation, to sell the aircraft.

The parties cited possible risk of damage and the cost of maintaining the jet, which was at one time apron-parked in Singapore.

A spokesman for Global One Aviation said a formal bidding process would start immediately.

“This agreement has been reached in cooperation with the United States government to ensure that the parties’ legal rights with respect to the jet are maintained, and that the jet’s value is not depleted while these claims are appropriately resolved,” the spokesman said in an emailed statement.

The court said bids for the Bombardier jet should meet or exceed a minimum reserve price, which Global One Aviation proposed to be set at $5.4 million. The court filing did not give a reason for the lower valuation of the aircraft.

The DoJ has said that some $4.5 billion was siphoned from 1MDB, and used by Low and his associates to buy the jet, the yacht, as well as Picasso paintings, jewellery, and real estate.

The Malaysian government had said it wanted to repossess the aircraft.

Low – the target of a Malaysian arrest warrant, and whose Malaysian passport has been revoked – has denied any wrongdoing.

A spokesman for Low, through his attorneys, said he “believes there is no jurisdiction where he can get a fair hearing in this matter”.

“Low will not submit to any jurisdiction where guilt has been predetermined by politics and self-interest overrules legal process,” he said via email (Reuters August 17, 2018).

His whereabouts are still unknown.

The proceeds from the sale will be held in an account maintained by the U.S. pending the conclusion of the asset forfeiture case, the court said.

In a separate filing the court also agreed to replace Jho Low’s stake in EMI Music Publishing in the forfeiture case with the proceeds from a proposed stake sale to Sony.

The U.S. civil lawsuits had sought to seize Low’s $107 million stake in EMI which the DOJ said was bought with stolen 1MDB funds. In May, Sony made a $2.3 billion offer to gain control of EMI.

A definitive approach to our rakyat misery is to tackle wastage, excessive spending and curb rampant corruption in government contracts which would have saved RM9.3 billion in 2014 alone based on the 20% competitive price by way of open tender with the development budget of RM46.5 billion then; the saved operational expenditure could even be more as that conservative 20% figure is often regarded by many analysts to be well below the actual “rent-seeking commissions” in many tendering bids.

But then, our PM was on high-in-the-air onboard the Perdana One Airbus ACJ320 (9H-AWK).

Amid austerity measures, even pro-UMNO bloggers were then questioning whether Prime Minister Najib Abdul Razak is now jetting across the country in a new luxury aircraft. In blog postings by, among others, Big Dog and RockyBru, they pointed to an Airbus ACJ320 with tail number 9H-AWK using the call number, “Perdana 2” or “NR2” – which incidentally are similar to Najib’s initials. The aircraft is registered in Malta and leased from aviation group Comlux.

According to aviation news website Aviation Week, Jet Premier One (M) Sdn Bhd, the company which manages flights for VVIPs in Malaysia, including Najib, had indeed leased the Airbus ACJ320 from Comlux.

The lease was supposed to be a temporary replacement for the regular aircraft Najib uses, an Airbus ACJ319, being refurbished by Comlux Aviation Services.

The Airbus ACJ319 with tail number 9M-NAA operated under the call name “NR1” or “Perdana 1” and is the official aircraft for the Prime Minister, similar to that of the US President’s Air Force One.

It first came under the spotlight in 2011 when Najib flew on the Airbus ACJ319 to Perth, Australia, apparently on holiday.

In a press release by Comlux, the company had announced it had won a contract to rework the VIP area of the Airbus ACJ319 as well as handle scheduled maintenance works for six years.

The company did not specify the value of the project. In the interim, Comlux leased an Airbus ACJ320 with tail number 9H-AWK to Jet Premier One. It took over the call name of “NR1” and “Perdana 1” and was spotted taking off from the Kuala Lumpur International Airport on one October 6 day to Denpasar Internatonal Airport, Bali, according to flight enthusiast site Jet Photos.

Najib then left for Bali on December 6 for the Asia Pacific Economic Conference (APEC) Summit.

‘RM27k an hour operate’

The aircraft comes with a lounge, a private room equipped with personal bathroom and has wifi and phone access while in the air. Comlux did not reveal how much the plane was leased for but according to the company’s brochure, the approximate operating cost for its Airbus ACJ320 flight is US$8,350.31 or RM$27,501.75 per hour.

In another previous press statement, Comlux had announced that it had completed refurbishing the “Head of State of Malaysia aircraft” Airbus ACJ319 after working on it since its arrival at its US base in June that year.

Despite the return of the plane, the lease for the Airbus ACJ320 appears to be still active and has been spotted jetting around in Malaysia.

According to air traffic tracker website Flight Radar24, the Airbus ACJ320 with tail number 9H-AWK last took off from KLIA under the call name “NR2” on December 31. The site also recorded the Airbus ACJ319 with tail number 9M-NAA taking off from KLIA on Dec 26 under the call name “NR1”.

In a parliamentary reply, Minister in the Prime Minister’s Department Shahidan Kassim revealed that the government spent RM14.95 million for fuel and RM160.08 million in maintenance for VVIP flights in 2012.

The government aircraft pool includes a Falcon, Global Express, Boeing Business Jet, Blackhawk, two Augustas and a Fokker F28. However, that reply did not mention either the Airbus AC319 or Airbus ACJ320.

‘PMO says aircraft lease over’

In an immediate response, the Prime Minister’s Office (PMO) said the lease of the Airbus ACJ320, which started on February 1, 2013, ended on December 31 that year. The PMO added that the lease of the Airbus ACJ320 was necessary due to a shortage of government aircraft.

Prior to this, it said the government had five aircraft, namely the ACJ319, BBJ, Fokker F28, Global Express and Falcon 900.

“In August 2012, the Fokker F28 aircraft was decommissioned as it was over 30 years old and was not replaced. Last year, the BBJ and ACJ319 were scheduled for compulsory maintenance. The BBJ went through maintenance between January to July 2013 while the ACJ319 went through maintenance between June 15 to Oct 8, 2013. As such, the PMO which is responsible for special government aircraft took the decision to lease the ACJ320 to overcome the shortage of aircraft,” it said.

The PMO added that the aircraft were not exclusively for Najib but is also used by the Agong, Sultans, Yang di-Pertuas, ministers, deputy ministers, foreign guests of the Federal Government, senior government officials and VIPs. It added that the aircraft allowed these individuals to move in and out of the country safely and helps with their busy schedule.

From the net, a belachan excess is belching:

This kangkung obsession is fast becoming a laughing stalk!

Lettuce get to the root of the problem,

we have mushroom for improvement,

everybody wants a celery increase but it’s like the government doesn’t carrot all,

sorry for being grump-pea.

He should just apologise and move on but sawi seems to be the hardest word.

These price increases don’t matter to the big shots but to the rakyat it tomato.

There must be a lady’s finger with a ring behind this.

Don’t worry.

While the rakyat suffer these cronies become like potatoes and may develop cauliflower like tumours.

In the meantime let’s enjoy all these jokes and remain cool like cucumber.

View also the Nasi Ganja flight captain being summoned, and later charged, for deviating from a scheduled flight route during the Covid-19 pandemic; details of incident (RakyatPost 07/05/2022).

3 FINE ARTS ENSNARLED

When the World’s Biggest Financial Scandal Ensnared the Art World

In late 2018, the actor and collector Leonardo DiCaprio made a visit to Washington, D.C., where he was ushered into a federal courthouse to secretly testify before a grand jury in a case that’s electrified the financial world: the multi-billion 1MDB scandal that started in Malaysia and has led to dozens of investigations and indictments globally, including the first criminal charges ever filed against Goldman Sachs.

DiCaprio, to be clear, isn’t a culprit in the scheme. Rather, the Titanic superstar has unique insight into how the funds ended up in a variety of bank accounts in the Cayman and British Virgin Islands, because it’s through DiCaprio and his friendship with Jho Low, the flamboyant financier at the center of 1MBD, that the scandal ensnared the free-spending arena of the contemporary art world.

(DiCaprio has offered no comment to the press, apart from a sentence from his spokesperson, saying that the actor, and his environmental foundation, will “continue to be entirely supportive of all efforts to assure that justice is done in this matter.”)

Low had snapped up jets, yachts, jewelry, and penthouses around the world with his embezzled billions, before investigative reporting in 2015 revealed the scheme and brought down the complicit Malaysian prime minister who personally reaped hundreds of millions and now faces criminal charges. Low also went on an art-buying spree in 2013 and 2014 that quickly tallied up to more than $200 million. And that spree largely began when his high-stakes gambling partner and Hollywood co-producer, DiCaprio, staged a charity sale at Christie’s.

Needless to say, DiCaprio and Low have since gone their separate ways. Low was formally indicted with three counts of criminal conspiracy to launder billions of dollars by the Eastern District of New York in November 2018. He is reportedly currently evading arrest by hiding out in China, where the PRC government had announced that it would assist Malaysia in looking for the fugitive.

But bold-faced art-world names litter the documents and criminal complaints that have amassed as investigations have ramped up in Washington, D.C. Aside from DiCaprio, art-world figures who did business deals with Low include the Sotheby’s financial services department, the Nahmad family, the private dealership SNS Fine Art, French mega-collector François Pinault, and former Christie’s post-war and contemporary chairman Loïc Gouzer.

Mystery Club Kid

Low first entered New York’s society pages in November 2009 when the New York Post ran an item about a Malaysian kid who came seemingly out of nowhere and allegedly began racking up $160,000 bar tabs during evenings on the town at Chelsea hotspots such as Avenue. Gawker was quick to assume that a twentysomething Wharton grad might be a front for some overseas billionaire, or up to something else shady. As one would have it, it was just before Low’s arrival in the Gotham gossip rags that the 1MDB fund was established by Malaysian prime minister Najib Razak, whose stepson Riza Aziz was an old schoolmate of Low’s in London.

1MDB was supposed to be a tranche of cash that could fund domestic cultural projects. Instead, the prime minister’s family and cronies moved the funds into Swiss and offshore accounts and found ways to invest them in high-priced luxury items. And according to the complaint filed by the U.S. Justice Department in 2017, it was in September 2009 that the first chunk of the misappropriated 1MDB funds were diverted into a Swiss bank account owned by Low, who then laundered US$400 million of it into the United States.

His flashy ways got Low in good with celebrities like Lindsay Lohan and Paris Hilton, and after meeting DiCaprio, he started inviting the actor on lavish trips, including flying him to the 2010 World Cup final in Johannesburg on a private jet. In May 2011, Low agreed to back a new production company, founded with Aziz and the talent scout Joey McFarland, that would fully fund the US$100 million budget of a movie DiCaprio was dying to make with Martin Scorsese. Major studios had backed out of funding the R-rated raunch-fest that they thought might fail to find an audience. That raunch-fest was The Wolf of Wall Street.

Bigger Price Tags

Low’s habit of paying for nebuchadnezzars of champagne at the club was a nice perk, but funding DiCaprio’s passion project truly endeared him to the actor; he thanked Jho Low and Riza Aziz both by name when accepting the Best Actor Golden Globe for The Wolf of Wall Street in 2014. Low was ready to support him on one other front. By May 2013, with filming on The Wolf of Wall Street wrapped, the actor returned to two of his other interests – art-collecting and environmentalism- by staging “The 11th Hour,” an auction of 33 works at Christie’s that would fund the many environmental causes supported by the Leonardo DiCaprio Foundation. The sale established 13 artist records and raised US$38.8 million, thanks in part to Low – he registered an account with Christie’s just days before the sale through his business associate Eric Tan, and the holding company Tan maintained for Low, Tanore Finance Corporation. Prior to that, it’s only clear that he had made a handful of private art purchases, one being the US$9.2 million Jean-Michel Basquiat painting, Redman One (1982), that he purchased from art dealer Helly Nahmad in March 2013.

At “The 11th Hour” – which DiCaprio organized alongside Gouzer, then a rising star at Christie’s – Low successfully acquired Mark Ryden’s Queen Bee (2013) for US$714,000 and Ed Ruscha’s Bliss Bucket (2010) for US$367,500. The charity auction appeared to be a gateway drug into art collecting. Two days later, at the post-war and contemporary art auction at Christie’s, Low was on the phone with Gouzer, instructing him to edge out Brett Gorvy to snag Basquiat’s Dustheads (1982) for US$48.8 million with fees – then a record for the artist. After adding two works by Alexander Calder, the total for the five-work haul acquired over three days was US$58.3 million.

The price tags kept getting higher. In June 2013, Christie’s arranged for Low to purchase Mark Rothko’s Untitled (Blue and Yellow) (1954) for US$71.5 million – directly from the collection of François Pinault, the owner of the auction house and one of the world’s biggest art collectors.

Opulent Auction Boxes

By the next set of sales, in November 2013, Low requested that Christie’s put him in one of its tricked-out skyboxes, where he and McFarland could bid in privacy while indulging in the trappings of the high life.

“It better look like Ceasar Palace [sic] in there,” one Christie’s employee emailed to another, according to the complaint. “The box is almost more important for the client than the art.”

Low bought La maison de Vincent à Arles (1888) by Vincent van Gogh for US$5.5 million at Christie’s impressionist and modern art evening sale and Pablo Picasso’s Tête de Femme (1935) for US$39.9 million at the equivalent sale at Sotheby’s one day later. He ended the year with a two-work private sale at Christie’s on December 20th, where he purchased Basquiat’s Head of a Madman (1982) for US$12 million and Concetto Spaziale, Attese (1967) by Lucio Fontana for US$36 million.

And then there were the works purchased from SNS Fine Art, a company associated with the auction vets–turned–private dealers Thomas Seydoux and Stephane Connery: among them, Claude Monet’s Saint-Georges Majeur (1908), which Low bought for US$35 million in December 2013 and had promptly shipped to the Geneva Free Port. He also snapped up five works by Calder, Roy Lichtenstein, Andy Warhol, and Yves Klein from an unnamed Monegasque art dealing outfit for more than US$18 million.

Low continued his buying spree into 2014, capping it with the purchase of Monet’s Nymphéas (1906), a small oil painting bought at Sotheby’s in London during the June sales; it set him back $57.5 million. And while many of the works were going to freeports, some had other destinations. Low had decided to gift a few works -the US$9.2 million Basquiat bought from Nahmad, and the US$3.2 million Picasso from the Monaco art dealer, along with a Diane Arbus photo purchased for US$750,000 – all to one person.

“Dear Leonardo DiCaprio,” read the handwritten note from Low’s associate, Eric Tan, that came with the Picasso. “Happy belated Birthday! This gift is for you.”

Project Cheetah

In 2014, Low also started sniffing around for a way to get a loan – quickly.

“Do you know of any banks, financiers who take art as security for raise bank loans for investments/acquisitions of more artwork?” he emailed an unnamed employee of SNS Fine Art on March 13, 2014. Low explained that he had around US$330 million in art that he could potentially put up as collateral, and was looking to get a 50 percent line on whatever he put up.

“I think those sort of numbers would scare off Sotheby’s,” the SNS employee responded.

And yet, it appears that, with Low’s track record of spending and that much being put up as collateral, Sotheby’s Financial Services, Inc., was not at all scared off by the request. The Malaysian, who at that point was gaining a reputation in art-selling circles as a guy to unload big works onto, had acute demands for speed and utter secrecy. As a Sotheby’s Financial Services employee emailed to colleagues on March 20, 2014:

“Just wanted to bring you up to speed on the big loan opportunity.…[The borrower] doesn’t want us to use his name in our communications, he wants to be referred to as ‘the client’ and we will refer to this transaction as project Cheetah (referring to the speed at which we are trying to move).”

Four days later, Low emailed the same executive, emphasizing the confidentiality in one email—“Most imp is that client name or if bvi borrower (then guarantor name) does not show up in any public searchable document or public accesible [sic] doc,” Low wrote. In another email, he emphasized the speed with which he needed the US$107 million, saying the the funds should be dispersed by April 7th – just two weeks.

They were a few days late. Low secured a deal with Sotheby’s on April 10th, through which he would leverage 17 works held in the Geneva Free Port, valued at somewhere between US$191.6 million and US$258.3 million, for a US$107 million loan. The loan was to be deposited in an account at the Caledonian Bank in the Cayman Islands listed as Triple Eight, Ltd.—an entity fully owned by Low.

The sum helped fund the art Low purchased in 2014 and 2015, including the US$57.5 million Monet. According to Tom Wright and Bradley Hope’s 2018 book Billion Dollar Whale: The Man Who Fooled Wall Street, Hollywood, and the World, the loan also almost funded the purchase of Picasso’s Les femmes d’Alger (Version “O”) (1955), which at the time was the most expensive artwork ever sold at auction. Low was purportedly the underbidder.

According to Wright and Hope, Low bragged to friends about his near-miss, saying that his final bid on the Picasso was for US$170 million. If that was the truth, then likely he would have been on the phone with his previous auction world go-between – and DiCaprio’s longtime pal – Loïc Gouzer, who was the only specialist battling against Brett Gorvy on the lot as it nosed toward its final price. Gouzer did indeed offer a bid of US$159.5 million – more than US$170 million with fees, but in the ballpark – but Gorvy took it up to US$160 million on behalf of his client, reportedly the former Qatari prime minister Hamad bin Jassim bin Jaber Al Thani, and the work hammered there, for a total of US$179.3 million.

Selling big, going dark

After failing to win the ultimate trophy, Low began to unload. A May 2016 story in the Wall Street Journal described how, starting in February 2015, Low sold dozens of artworks for more than US$200 million – even though most of the lots sold for well under what Low paid for them. The record-breaking Basquiat Dusthes painting he bought for US$48.8 million. In April 2016, it went to hedge funder Daniel Sundheim for US$35 million. The Rothko he bought from Monsieur Pinault for US$70 million. It sold at Sotheby’s in New York in May 2015 for US$46.5 million. The Monet he bought at Sotheby’s in London in June 2014 for £33.8 million (US$57.5 million). It was sold privately to a dealer in Hong Kong for €25.2 million – well below the €42.3 million equivalent he had paid.

The investigation into 1MDB was closing in on Low. Clare Rewcastle Brown, a London-based investigative reporter who focuses on Malaysian corruption, (posting under as the Sarawak Report) teamed with the Sunday Times to publish the first exposé on what it called the “heist of the century” in February 2015. In July, that was followed by a report in the Wall Street Journal that the current prime minister, Najib Razak – Riza Aziz’s stepfather – had taken US$700 million from the 1MDB fund. He denied the allegations, and in January 2016, an ally who had quickly become attorney general – replacing the former AG due to vague “health reasons” -;cleared Razak of wrongdoing. But Swiss and Singaporean prosecutors began to investigate, leading to June 2016, when U.S. attorney general Loretta Lynch announced the civil forfeiture demand, seizing more than US$1 billion in assets in the form of luxury items purchased with 1MDB funds. That request lead to a lawsuit filed by the U.S. Justice Department in June 2017.

By that time, Low had disappeared – not just from the art world, but from the entire world at large. He was wanted by the authorities in the United States, Singapore, and Malaysia, and there were reports that he was hiding out in a hotel in Shanghai evading capture through plastic surgery and a global network of tipsters. Despite the announcement that China would help Malaysia find the fugitive who masterminded the largest embezzlement scandal in decades, there had been little luck thus far. The then Inspector-General Mohamad Fuzi Harun from the Royal Malaysian Police said that “the police are also communicating with Interpol and the status is the same.”

As for Leo’s art? In 2017, prior to offering his testimony, DiCaprio handed over to the government the paintings that the shamed financier, and former friend, had given him over the years. He even gave up the Basquiat that was gifted as a belated birthday present.

4 REAL ESTATES REAL ECSTACY

KUALA LUMPUR (Reuters) – U.S. prosecutors are seeking to sell a US$39-million Los Angeles mansion allegedly bought by fugitive Malaysian financier Low Taek Jho with money stolen from a state fund, court filings showed.

Low, popularly known as Jho Low, has been charged in Malaysia and the United States for his central role in the alleged theft of US$4.5 billion from state fund 1Malaysia Development Berhad (1MDB).

Low, whose whereabouts are unknown, has consistently denied wrongdoings through spokesmen.

In 2017, the U.S. Department of Justice (DoJ) filed civil forfeiture lawsuits on several assets said to have been bought with stolen 1MDB funds, including the mansion near Hollywood’s famed Sunset Strip.

The mansion was now empty and falling into disrepair, costing nearly US$690,000 in maintenance, insurance and taxes annually, U.S. prosecutors and the property’s holding company said on Friday.

A sale of the property was necessary as “the expense of keeping the property is excessive and/or is disproportionate to its fair market value”, the parties said in the filing in a California court.

The money from the proposed sale will be held in a government account pending the outcome of the forfeiture case, they said.

The parties filed a separate request for the court to lift a stay on the forfeiture lawsuit so that the sale can proceed.

Low’s spokesman said in a statement his client was aware of the proposed sale to “preserve the property’s value while ensuring the owners’ claims are protected and may proceed in a timely fashion.”

“We look forward to the continued amicable resolution of these claims,” the spokesman said.

The DoJ, in the biggest case to date in its anti-kleptocracy program, is pursuing billions of dollars it says were misappropriated from 1MDB, a state fund founded by former Malaysian prime minister Najib Razak.

U.S. prosecutors say funds diverted from 1MDB were used by Low and several associates to buy about US$1.7 billion in assets including luxury real estate, a private jet, jewelry and art.

The United States will return to Malaysia US$200 million recovered as part of the seizure of 1MDB-linked assets, sources have told Reuters.

Najib, who lost power in a general election onn2018, is facing more than 40 criminal charges related to losses at 1MDB and other government entities. He has consistently denied wrongdoing.

Whereby, the Department of Statistics Malaysia (DoSM) figures released had shown that the average monthly salary and wage received by workers in the country was RM3,224 in 2019; a typical apartment in the Klang Valley is one hundred times say on this basic monthly salary. The Household Income & Basic Amenities Survey Report 2019 by DOSM had shown that the country’s 2019 median income of a household of four is RM5,873. Meanwhile, this means it is sixty times of both parents’ monthly salaries to get a decent shelter.

Presently, there is a total of about 10 million salary and wage recipients in Malaysia.

To read further: STORM, The Struggle for Shelter

5 WALL STREET WOLVES

The Wolf of Wall Street producer Riza Aziz, who is the stepson of former Malaysian prime minister Najib Razak, has been charged with embezzling US$248m into Swiss bank.

Riza, who ran a Hollywood production company Red Granite Pictures, appeared in a Kuala Lumpur court on a Friday morning charged with five counts of money laundering, accused of receiving US$248 million into Swiss bank accounts from the Malaysian state fund 1MDB, which was controlled by Najib. Each charge carries a five-year jail sentence.

Riza is now the third member of the former first family of Malaysia to face multiple charges linked to misappropriated 1MDB funds. Najib, who was toppled from power in May 2018, is facing 42 corruption charges and his first trial of at least three is ongoing. Najib’s wife and Riza’s mother, Rosmah Mansour, has also been charged with 17 counts of money laundering. Wolf of Wall Street producers to pay US$60m to US government

The 1MDB scandal, described as the biggest corruption scandal in Malaysian history, involved billions of dollars being embezzled from a government fund and fraudulently spent around the world. Some US$681m (£516m) of 1MDB money went into Najib’s personal bank account, where it is alleged it was used to fund the lavish spending habits of Najib and Rosmah. The US justice department believes more than US$4.5bn was stolen overall. The couple deny all wrongdoing.

It was a US justice department (DOJ) investigation that first accused Red Granite productions of using stolen 1MDB money to fund Hollywood productions, from Wolf of Wall Street to Dumb and Dumber 2 and Daddy’s Home. The company had agreed to pay a US$60m fine, though it stated that the payment was not “an admission of wrongdoing”.

Red Granite was a relative unknown on the Hollywood scene before it stumped up US$100m to help director Martin Scorsese make The Wolf of Wall Street. Three months after shooting began, Red Granite also presented the film’s star, Leonardo DiCaprio, with the Oscar given to Marlon Brando for On the Waterfront, worth around US$600,000, as a lavish birthday present. DiCaprio has since surrendered the statue as part of the 1MDB investigation.

With an oligarch governance, under a monopoly-capital controlled domain, where illicit tradings and illegal practices are the norms of capitalism, it is not surprising to know that seven of the top 10 highest-paid boards of the companies in Malaysia’s bellwether index are family-controlled companies, which are also where the top 10 highest-paid chief executive officers (CEOs) are mainly from:

To READ further in depth the distorted Malaysian political economy:

- Corporate Capital with Coronavirus

- Economic Nationalism in an Ethnocratic Economy

- Colonial Racial Capitalism to Clientel Ethnocapitalism

- Capitalism and Unsettled Landlessness

- Development of Underdevelopment

EPILOGUE

The way out of this economic inequality may be a proletariat and peasant movement in redistributing (FELDA) land and (ethnocractic) capital, and establishing a new regime based on collective effort, sharing of the distributed wealth toward common prosperity with the creed of the predominance of wholesome interests of society over the interests of a selected ethnocapital few.